|

|

【IWCITY 1589 交流专区】依斯干达海滨城市(前名 TEBRAU )

[复制链接]

[复制链接]

|

|

|

发表于 24-3-2018 06:24 AM

|

显示全部楼层

发表于 24-3-2018 06:24 AM

|

显示全部楼层

本帖最后由 icy97 于 26-3-2018 01:35 AM 编辑

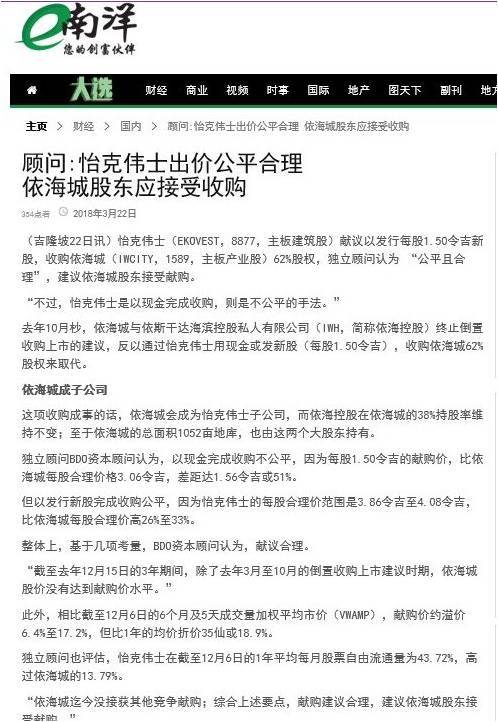

Subject | INDEPENDENT ADVICE CIRCULAR TO THE HOLDERS OF THE OFFER SHARES IN RELATION TO THE CONDITIONAL VOLUNTARY TAKE-OVER OFFER BY EKOVEST BERHAD TO ACQUIRE ALL ORDINARY SHARES IN ISKANDAR WATERFRONT CITY BERHAD ("IWCITY") ("IWCITY SHARES") AND ANY NEW IWCITY SHARES THAT MAY BE ISSUED PRIOR TO THE CLOSING DATE OF THE OFFER ARISING FROM THE EXERCISE OF OUTSTANDING EMPLOYEE SHARE OPTIONS IN IWCITY (BOTH COLLECTIVELY REFERRED TO AS THE "OFFER SHARES") FOR A CONSIDERATION OF RM1.50 PER OFFER SHARE, WHICH SHALL BE SATISFIED BY WAY OF A CASH CONSIDERATION OF RM1.50 FOR EVERY 1 OFFER SHARE SURRENDERED OR A SHARE EXCHANGE BASED ON AN EXCHANGE RATIO OF 1 NEW ORDINARY SHARE IN EKOVEST BERHAD TO BE ISSUED AT AN ISSUE PRICE OF RM1.50 EACH FOR EVERY 1 OFFER SHARE SURRENDERED ("OFFER") |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5731825

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-3-2018 02:52 AM

|

显示全部楼层

发表于 30-3-2018 02:52 AM

|

显示全部楼层

Type | Announcement | Subject | TAKE-OVERS & MERGERS (PARAGRAPH/RULE 9.19 (47A)) | Description | ISKANDAR WATERFRONT CITY BERHAD ("IWCITY" OR "THE COMPANY")- CONDITIONAL VOLUNTARY TAKE-OVER OFFER BY EKOVEST BERHAD ("EKOVEST" OR "THE OFFEROR") (OFFER) | (Unless otherwise stated, all definitions and terms used in this announcement shall have the same meanings as defined in the announcement dated 18 December 2017.)

We refer to the announcements dated 18 December 2017, 21 December 2017, 8 January 2018 and 12 March 2018 in relation to the Offer.

The Board of Directors of IWCity wishes to announce that IWCity has today received a press notice from Mercury Securities Sdn Bhd on behalf of the Offeror, informing that the shareholders of Ekovest have not approved the resolution pertaining to the Offer at its extraordinary general meeting today.

In view of the above, the Offer has lapsed and all acceptances received pursuant to the Offer will be returned to the respective shareholders of IWCity.

A copy of the press notice is attached herewith.

This announcement is dated 29 March 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5740577

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-4-2018 03:19 AM

|

显示全部楼层

发表于 14-4-2018 03:19 AM

|

显示全部楼层

本帖最后由 icy97 于 15-4-2018 04:24 AM 编辑

Type | Announcement | Subject | MATERIAL LITIGATION | Description | ISKANDAR WATERFRONT CITY BERHAD ("IWCITY") OR ("THE COMPANY")High Court of Johor Bahru, Johor Summons No. JA-21NCvC-8-03/2018Kerajaan Malaysia ("Plantiff") vs Tebrau Bay Constructions Sdn. Bhd. ("Defendant") | The Board of Directors of IWCity wishes to inform that Tebrau Bay Constructions Sdn Bhd (“TBCSB”), a wholly-owned subsidiary of the Company, had on 12 April 2018, been served with a Writ of Summon and Statement of Claim dated 15 March 2018 by the Government of Malaysia (“the Plaintiff”).

1. Date of receipt of the Writ of Summon and Statement of Claim Both the Writ of Summon and Statement of Claim dated 15 March 2018 were served on TBCSB at its registered office on 12 April 2018.

2. Particulars of the claims under the Writ of Summon and Statement of Claim The claims pursuant to the Writ of Summon and Statement of Claim are as follows: (a) The Writ of Summon was issued by Inland Revenue Board of Malaysia (“IRB”) for and on behalf of the Plaintiff; (b) A claim by the Plaintiff for RM32,227,942.16; (c) Interest of 5% per annum on RM32,227,942.16 from the date of judgement until the date of realisation; (d) Costs; and (e) Such further or other reliefs as the Honourable Court deems fit and proper to grant.

3. Details of the circumstances leading to the filing of the Writ of Summon and Statement of Claim against TBCSB The circumstances leading to the filing of the Writ of Summon and Statement of Claim against TBCSB are as follows: (a) IRB had raised additional income taxes assessment and tax penalties amounting to RM36,983,955.00 (“Additional Assessment”) to TBCSB for years of assessment 2010, 2012 and 2014. TBCSB did not received the notices of assessment dated 16 August 2017 but was only notified of the said notices via email on 24 January 2018; (b) TBCSB disagreed on the basis of the Additional Assessment and had filed a formal appeal against the Additional Assessment by submitting the prescribed Form N to IRB seeking for extension of time; (c) TBCSB has not paid the Additional Assessment pending the outcome from IRB; and (d) The Additional Assessment and tax penalties imposed as stated above still remain outstanding.

4. The financial and operational impact of the Writ of Summon and Statement of Claim on the IWCity Group Upon consulting its tax consultants and solicitors, TBCSB is of the view that there are reasonable grounds to challenge the basis and validity of the disputed Additional Assessment raised by IRB. In this regard, at this juncture, the Company is not able to ascertain the financial impact arising from the claims. The claims, however, are not expected to have any material operational impact on the IWCity Group.

5. Proposed steps to be taken in respect of the Writ of Summon and Statement of Claim The Company is currently seeking the advice from the tax consultants and solicitors to handle the matter and any further material development of the above matter will be announced in due course.

This announcement is dated 12 April 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-6-2018 01:03 AM

|

显示全部楼层

发表于 12-6-2018 01:03 AM

|

显示全部楼层

本帖最后由 icy97 于 18-6-2018 11:55 PM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 32,067 | 13,785 | 32,067 | 13,785 | | 2 | Profit/(loss) before tax | 1,216 | -55,727 | 1,216 | -55,727 | | 3 | Profit/(loss) for the period | 815 | -56,424 | 815 | -56,424 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 815 | -56,424 | 815 | -56,424 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.10 | -6.97 | 0.10 | -6.97 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9700 | 0.9700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-6-2018 04:18 AM

|

显示全部楼层

发表于 23-6-2018 04:18 AM

|

显示全部楼层

Type | Announcement | Subject | MATERIAL LITIGATION | Description | ISKANDAR WATERFRONT CITY BERHAD ("IWCITY") OR ("THE COMPANY")High Court of Johor Bahru, Johor Summons No. JA-21NCvC-8-03/2018Kerajaan Malaysia ("Plantiff") vs Tebrau Bay Constructions Sdn. Bhd. ("Defendant") | (all definitions and terms used below shall be consistent with the announcement dated 12 April 2018)

We make reference to our announcement in relation to the above matter dated 12 April 2018.

The Board wish to announce that TBCSB, our wholly-owned subsidiary had, following the full settlement of the taxes claimed, on 19 June 2018 received the sealed court order dated 20 May 2018 that the Writ and Plaintiff’s Statement of Claim dated 15 March 2018 is withdrawn without any order as to costs.

Notwithstanding the above settlement, TBCSB shall continue to make the necessary appeals to IRB against the Additional Assessments.

This announcement is dated 19 June 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-7-2018 03:00 AM

|

显示全部楼层

发表于 21-7-2018 03:00 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | ISKANDAR WATERFRONT CITY BERHAD ("IWCITY" OR "THE COMPANY")- Unusual Market Activities | With reference to the recent sharp rise in the price and volume of IWCity shares, the Company wishes to announce that it is not aware of any news that may give rise to the aforesaid trading activities.

Further, as to the article in The Edge Financial Daily entitled “IWCity, Ekovest surge on renewed Bandar Malaysia talks” on 20th July 2018, the Company has been informed by its parent company, Iskandar Waterfront Holdings Sdn Bhd (“IWH”) that it has not submitted any renewed bid for the Bandar Malaysia project.

This announcement is dated 20 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-7-2018 05:35 AM

|

显示全部楼层

发表于 21-7-2018 05:35 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 05:13 AM

|

显示全部楼层

发表于 31-8-2018 05:13 AM

|

显示全部楼层

本帖最后由 icy97 于 4-9-2018 02:11 AM 编辑

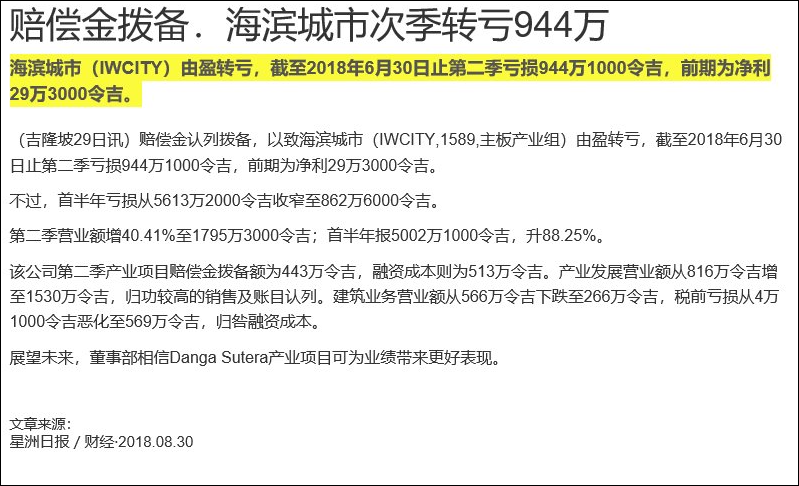

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 17,953 | 12,786 | 50,021 | 26,571 | | 2 | Profit/(loss) before tax | -10,698 | 546 | -9,482 | -55,182 | | 3 | Profit/(loss) for the period | -9,441 | 293 | -8,626 | -56,132 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -9,441 | 293 | -8,626 | -56,132 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.13 | 0.04 | -1.03 | -6.86 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9700 | 0.9700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-12-2018 07:20 AM

|

显示全部楼层

发表于 29-12-2018 07:20 AM

|

显示全部楼层

本帖最后由 icy97 于 8-1-2019 08:16 AM 编辑

IWCity第三季净利狂泻至45万

Supriya Surendran/theedgemarkets.com

November 28, 2018 20:07 pm +08

http://www.theedgemarkets.com/article/iwcity第三季净利狂泻至45万

(吉隆坡28日讯)在没有卖地收益的情况下,Iskandar Waterfront City Bhd(IWCity)截至今年9月杪第三季(2018财年第三季)净利骤降至44万9000令吉,上财年同季为8839万令吉。

季度营业额也从2亿1712万令吉,按年大跌91.4%至1867万令吉。

由丹斯里林刚河掌控的IWCity在现财年首9个月净亏818万令吉,2017财年首9个月则净赚3226万令吉。

2018财年首9个月营业额报6869万令吉,较2017财年同期的2亿4370万令吉,按年狂泻71.8%。

现财年首9个月每股亏损为0.98仙,上财年同期每股盈利为3.95仙。

在任何无可预见的情况下,该集团估计,可在现财年末季获得满意的表现。

(编译:魏素雯)

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 18,674 | 217,126 | 68,695 | 243,697 | | 2 | Profit/(loss) before tax | 158 | 142,598 | -9,324 | 87,417 | | 3 | Profit/(loss) for the period | 449 | 88,391 | -8,177 | 32,260 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 449 | 88,391 | -8,177 | 32,260 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.06 | 10.80 | -0.98 | 3.95 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9700 | 0.8100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-2-2019 08:15 PM

|

显示全部楼层

发表于 27-2-2019 08:15 PM

|

显示全部楼层

本帖最后由 icy97 于 28-2-2019 04:22 AM 编辑

| 1589 IWCITY ISKANDAR WATERFRONT CITY BERHAD | | Quarterly rpt on consolidated results for the financial period ended 31/12/2018 | | Quarter: | 4th Quarter | | Financial Year End: | 31/12/2018 | | Report Status: | Unaudited | | Submitted By: | | | | | Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period | | | 31/12/2018 | 31/12/2017 | 31/12/2018 | 31/12/2017 | | | RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 52,708 | 25,158 | 118,476 | 267,632 | | 2 | Profit/Loss Before Tax | 1,279 | (23,240) | (8,046) | 64,177 | | 3 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,573 | 13,413 | (6,604) | 45,673 | | 4 | Net Profit/Loss For The Period | 1,573 | 13,413 | (6,604) | 45,673 | | 5 | Basic Earnings/Loss Per Shares (sen) | 0.19 | 1.63 | (0.79) | 5.58 | | 6 | Dividend Per Share (sen) | 0.00 | 0.00 | 0.00 | 0.00 | | | | | As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) | | | 0.9700 | 0.9700 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-3-2019 07:24 PM

|

显示全部楼层

发表于 6-3-2019 07:24 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 9-4-2019 09:31 PM

|

显示全部楼层

发表于 9-4-2019 09:31 PM

|

显示全部楼层

敢敢买。。。。。。。。。。。.gif) |

|

|

|

|

|

|

|

|

|

|

|

发表于 10-4-2019 07:58 PM

|

显示全部楼层

发表于 10-4-2019 07:58 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 13-4-2019 05:58 PM

|

显示全部楼层

发表于 13-4-2019 05:58 PM

|

显示全部楼层

赚了几千块。。。。。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 17-4-2019 08:35 PM

|

显示全部楼层

发表于 17-4-2019 08:35 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 18-4-2019 09:47 PM

|

显示全部楼层

发表于 18-4-2019 09:47 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 19-4-2019 11:15 PM

|

显示全部楼层

发表于 19-4-2019 11:15 PM

|

显示全部楼层

RM1.03...........一天地狱一天天堂。。。。.gif) .gif) |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-4-2019 12:10 PM

|

显示全部楼层

发表于 22-4-2019 12:10 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 23-4-2019 10:53 PM

|

显示全部楼层

发表于 23-4-2019 10:53 PM

|

显示全部楼层

开市就大跌!!!明天公佈好消息。。。  |

|

|

|

|

|

|

|

|

|

|

|

发表于 24-4-2019 08:10 PM

|

显示全部楼层

发表于 24-4-2019 08:10 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|