|

|

发表于 14-7-2018 05:03 AM

|

显示全部楼层

发表于 14-7-2018 05:03 AM

|

显示全部楼层

本帖最后由 icy97 于 17-7-2018 05:49 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-7-2018 05:40 AM

|

显示全部楼层

发表于 26-7-2018 05:40 AM

|

显示全部楼层

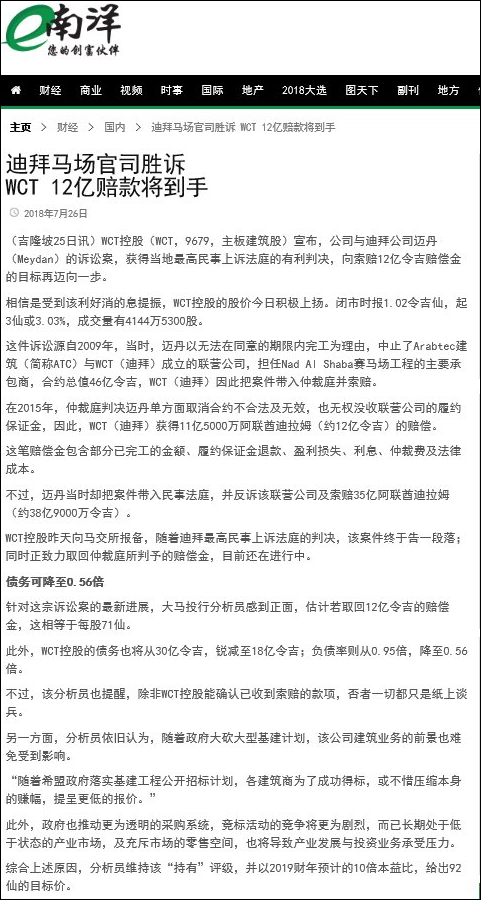

Type | Announcement | Subject | MATERIAL LITIGATION | Description | WCT HOLDINGS BERHAD ("WCT" OR "THE COMPANY")UPDATES ON THE NAD AL SHEBA DUBAI RACECOURSE CONTRACT DISPUTE | Reference is made to the previous announcements dated 27th June 2012 and 27th March 2013 pertaining to the Dubai Court Commercial Action No. 1066/2012 (“Civil Suit”) initiated by Meydan claiming jointly against WCT Berhad (Dubai Branch) (“WCTB”) and Arabtec Construction LLC (“Arabtec”), a sum of AED3.5 billion.

The Board of Directors of WCT wishes to announce that it has been informed by WCTB’s appointed lawyers in Dubai that the Dubai Civil Court of Cassation (“COC”) has on 22 July 2018 dismissed Meydan’s appeal in respect of the earlier Court of First Instance and Court of Appeal’s dismissals / rejections of Meydan’s Civil Suit. The Board has further been advised that the COC is the highest civil appeal court in Dubai and the Civil Suit is therefore now concluded.

In the meantime and with reference to the previous announcement dated 8th July 2015, proceedings to ratify and thereafter to enforce the Arbitral Award issued in favour of WCTB on 8 July 2015 remain ongoing.

This announcement is dated 24 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-7-2018 12:27 AM

|

显示全部楼层

发表于 27-7-2018 12:27 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | WCT Holdings Berhad ("WCT" or "the Company") Kuala Lumpur High Court Civil Suit by AEON Co. (M) Bhd against Gemilang Waras Sdn. Bhd. | (Unless otherwise stated, all capitalised terms used in this announcement shall have the same meaning as ascribed thereto in the announcements dated 10 November 2017, 6 December 2017 and 2 May 2018 in relation to the Kuala Lumpur High Court Civil Suit by AEON Co. (M) Bhd against Gemilang Waras Sdn. Bhd. (“the Suit”)) We refer to the announcements made on 10 November 2017, 6 December 2017 and 2 May 2018 in respect of the above matter.

The Board of Directors of WCT wishes to inform that Gemilang Waras Sdn Bhd, an indirect wholly-owned subsidiary of the Company (“the Defendant”) and AEON Co. (M) Bhd (“the Plaintiff”) (collectively referred as the “Parties”) have entered into a consent order on 4th July 2018 pending the disposal of the Plaintiff’s Notice of Appeal dated 15th May 2018 at the Court of Appeal (“the Plaintiff’s Appeal”). The Defendant has today received a copy of the sealed consent order (“the Consent Order”) through its solicitors. The Consent Order provides as follows:- 1. That the Order dated 27th April 2018 made by the High Court in the Suit (“the High Court Order”) be stayed until the disposal of the Plaintiff’s Appeal on the following terms; 1.1 That the sum of RM5,128,906.36 previously paid by the Plaintiff to and kept by the Defendant, shall be retained by the Defendant; 1.2 That the Plaintiff is to pay the Defendant the sum of RM13,275,480.58 by 6th July 2018 (the Plaintiff has already complied with this paragraph); 1.3 That the Plaintiff is to pay the sum of RM2,419,295.45 (being an amount equivalent to the last monthly rental sum previously being paid by the Plaintiff immediately prior to the expiry of the Lease) to the Defendant by the 14th day of each month commencing from July 2018 until the disposal of the Plaintiff’s Appeal or until November 2019, whichever is the earlier; 1.4 That subject to the Plaintiff complying with paragraphs 1.1 to 1.3 above, the Plaintiff shall remain in possession of AEON Mall Bukit Tinggi until the disposal of the Plaintiff’s Appeal; 1.5 That the monies paid above shall be applied towards damages or towards rentals in accordance with the orders made upon the disposal of the Plaintiff’s Appeal.

2. That in the event the Plaintiff breaches or defaults in any of the payment terms and further fails to remedy such default within 14 days of the Defendant’s written notice, the Defendant shall be entitled to forthwith proceed with execution and enforcement of the High Court Order;

3. That the Plaintiff is to pay into a trust account the costs and expenses incurred by the Defendant for the maintenance, repair, servicing and upkeep of AEON Mall Bukit Tinggi on the part of the Plaintiff in relation to the Lease Agreement dated 23rd November 2007 and which monies paid shall be applied towards damages to the Defendant or to be returned to the Plaintiff in accordance with the orders made upon the disposal of the Plaintiff’s Appeal;

4. That Parties are at liberty to apply to court for such directions as is necessary including in respect of the assessment of the damages ordered pursuant to the High Court Order and in the review of the sums payable with effect from November 2019 to such rate not exceeding 12% over the sum of RM2,419,295.45; and

5. That the Consent Order made is without prejudice to the rights of the Plaintiff and the Defendant in respect of all matters raised in the main action and the counterclaim.

The Company will make further announcement of any material development arising from the above proceeding as and when necessary.

This announcement is dated 26 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-8-2018 01:36 AM

|

显示全部楼层

发表于 8-8-2018 01:36 AM

|

显示全部楼层

Name | TAN SRI LIM SIEW CHOON | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 07 Aug 2018 | 17,000,000 | Others | Direct Interest | Name of registered holder | Tan Sri Lim Siew Choon | Address of registered holder | 21, Jalan Tunku, Bukit Tunku, 50480 Kuala Lumpur | Description of "Others" Type of Transaction | Direct Business Deal |

Circumstances by reason of which change has occurred | Purchase of shares via Direct Business Transaction | Nature of interest | Direct Interest | Direct (units) | 24,100,000 | Direct (%) | 1.741 | Indirect/deemed interest (units) | 247,207,674 | Indirect/deemed interest (%) | 17.859 | Total no of securities after change | 271,307,674 | Date of notice | 07 Aug 2018 | Date notice received by Listed Issuer | 07 Aug 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2018 06:27 AM

|

显示全部楼层

发表于 28-8-2018 06:27 AM

|

显示全部楼层

本帖最后由 icy97 于 3-9-2018 06:51 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 669,901 | 382,814 | 1,209,692 | 855,698 | | 2 | Profit/(loss) before tax | 66,177 | 38,175 | 121,474 | 82,707 | | 3 | Profit/(loss) for the period | 41,681 | 21,268 | 79,980 | 51,738 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 43,777 | 21,246 | 82,162 | 54,090 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.11 | 1.53 | 5.83 | 4.09 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.2200 | 2.2200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-9-2018 07:04 AM

|

显示全部楼层

发表于 3-9-2018 07:04 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 15-9-2018 03:25 AM

|

显示全部楼层

发表于 15-9-2018 03:25 AM

|

显示全部楼层

本帖最后由 icy97 于 15-9-2018 05:27 AM 编辑

icy97 发表于 13-7-2018 02:52 AM

WCT获5.55亿令吉TRX综合发展工程

Supriya Surendran/theedgemarkets.com

July 12, 2018 21:11 pm +08

(吉隆坡12日讯)WCT控股(WCT Holdings Bhd)获Lendlease Projects(马)私人有限公司颁发总值5.55亿令吉 ...

Type | Announcement | Subject | OTHERS | Description | Proposed Commercial Mixed Development on Plot 1 comprising: (i) 4 levels of Shopping Complex, (ii) 3 levels of Car Park, (iii) 1 level Open Landscape with Retail Space and 1 Information Centre (future development), (iv) Future Development Plot, on Lot PT157, Seksyen 67, Jalan Tun Razak / Jalan Davis, Bandaraya Kuala Lumpur.- Trade Package No. TP 02 Superstructure, Façade and Blockworks (Works) | We refer to the announcement made on 12 July 2018 in respect of the above matter.

The Board of Directors of WCT Holdings Berhad (“WCT” or “the Company”) is pleased to announce that following the execution of the Preliminary Works Agreement on 12 July 2018, WCT Berhad (“WCTB”) and Lendlease Projects (M) Sdn Bhd have on 14 September 2018 executed the Trade Contract for the Works awarded to WCTB for a contract value of RM555.0 million.

The Works are expected to be completed within 104 weeks from August 2018.

None of the Directors or major shareholders of the Company or persons connected with them have any interest, direct or indirect, in the Trade Contract.

This announcement is dated 14 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-9-2018 01:55 AM

|

显示全部楼层

发表于 19-9-2018 01:55 AM

|

显示全部楼层

本帖最后由 icy97 于 19-9-2018 05:31 AM 编辑

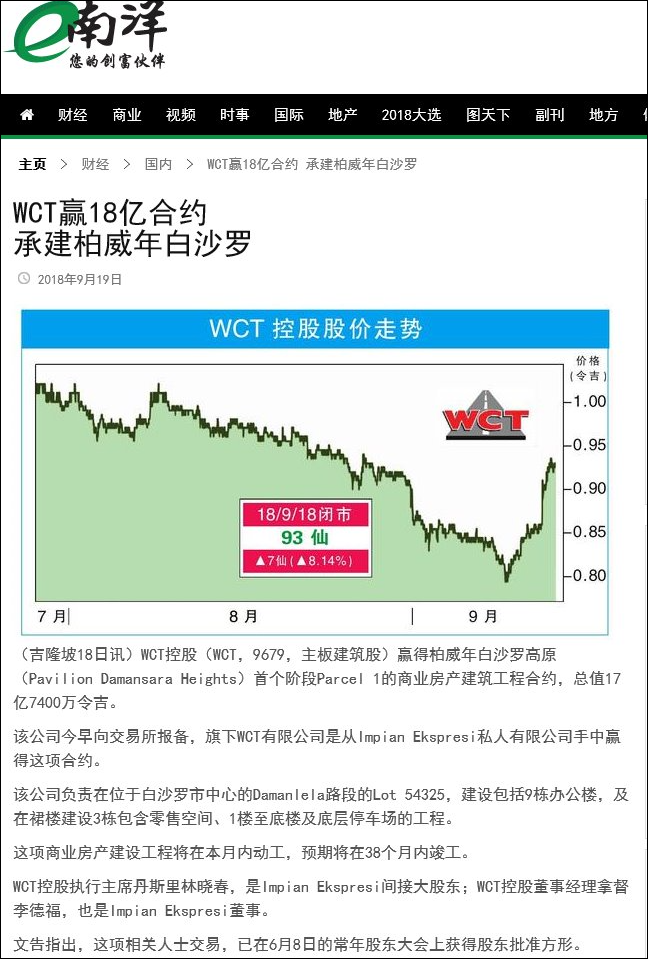

Type | Announcement | Subject | OTHERS | Description | Proposed Construction and Completion for a Project known as "Cadangan Kerja-kerja Superstruktur untuk Cadangan Pembangunan Perniagaan yang melibatkan 9 Blok Pejabat dan 3 Blok Pangsapuri Servis diatas 1 Blok Podium 4 Tingkat Ruang Perniagaan dengan 1 Tingkat bawah tanah, 1 Tingkat Mezzanin dan 8 Tingkat Basemen (Pavilion Damansara Height-Parcel 1) Di atas Lot 54325 Jalan Damanlela, off Lebuhraya Sprint, Pusat Bandar Damansara, Mukim Kuala Lumpur, Wilayah Persekutuan, for Impian Ekspresi Sdn Bhd" | The Board of Directors of WCT Holdings Berhad (“WCT” or “the Company”) is pleased to announce that WCT Berhad (“WCTB”), a wholly-owned subsidiary of the Company has on 14 September 2018 accepted a letter of award from Impian Ekspresi Sdn Bhd (“IESB” or the “Employer”) for the construction and completion of the aforementioned Project (forming part of the Pavilion Damansara Heights proposed commercial development) for a contract sum of approximately RM1.774 billion (“Contract”).

The scope of works under the Contract shall encompass the execution and completion of 9 blocks of office tower and 3 blocks of service apartment on a podium block comprising retail space, mezzanine floors and works to lower ground floor and basement car park.

The works under the Contract are expected to be completed within a period of 38 months. The Contract is expected to commence in September 2018.

The acceptance of the Contract is considered a recurrent related party transaction (“RRPT”) between the WCT Group and IESB, which is a related party, for which the Company had obtained its shareholders’ mandate at the Company’s 7th Annual General Meeting held on 6 June 2018.

IESB is a company in which Tan Sri Lim Siew Choon, the Executive Chairman of WCT has an indirect equity interest and both Tan Sri Lim Siew Choon and Dato’ Lee Tuck Fook, the Group Managing Director of WCT, sit on the Board of IESB.

This announcement is dated 18 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-9-2018 07:30 AM

|

显示全部楼层

发表于 20-9-2018 07:30 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 23-9-2018 05:29 AM

|

显示全部楼层

发表于 23-9-2018 05:29 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 25-9-2018 07:19 AM

|

显示全部楼层

发表于 25-9-2018 07:19 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 9-10-2018 05:07 AM

|

显示全部楼层

发表于 9-10-2018 05:07 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 18-10-2018 05:13 AM

|

显示全部楼层

发表于 18-10-2018 05:13 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | WCT Holdings Berhad ("WCT" or "the Company")Kuala Lumpur High Court Civil Suit by AEON Co. (M) Bhd against Gemilang Waras Sdn Bhd | (Unless otherwise stated, all capitalised terms used in this announcement shall have the same meaning as ascribed thereto in the announcements dated 10 November 2017, 6 December 2017, 2 May 2018 and 26 July 2018 in relation to the Kuala Lumpur High Court Civil Suit by AEON Co. (M) Bhd against Gemilang Waras Sdn. Bhd. (“the Suit”))

We refer to the announcements made on 10 November 2017, 6 December 2017, 2 May 2018 and 26 July 2018 in respect of the above matter.

The Board of Directors of WCT wishes to inform that Gemilang Waras Sdn Bhd, an indirect wholly-owned subsidiary of the Company (“the Defendant”) and AEON Co. (M) Bhd (“the Plaintiff”) (collectively referred as the “Parties”) have on 17 October 2018 agreed to an amicable out-of-court settlement and have executed a Supplemental Lease Agreement (“Supplemental Lease Agreement”) to further renew the lease period for another 6 years commencing from 24 November 2017, subject to options to renew for a further 2 terms, comprising 6 years and 3 years respectively.

Upon the execution of the Supplemental Lease Agreement, the Parties have agreed and shall proceed with the withdrawal of their respective appeals and cross-appeals. Further, the Defendant has agreed and undertaken that it would not enforce the High Court Order dated 27 April 2018.

This announcement is dated 17 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-11-2018 07:06 AM

|

显示全部楼层

发表于 1-11-2018 07:06 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 5-12-2018 06:55 AM

|

显示全部楼层

发表于 5-12-2018 06:55 AM

|

显示全部楼层

本帖最后由 icy97 于 8-1-2019 07:48 AM 编辑

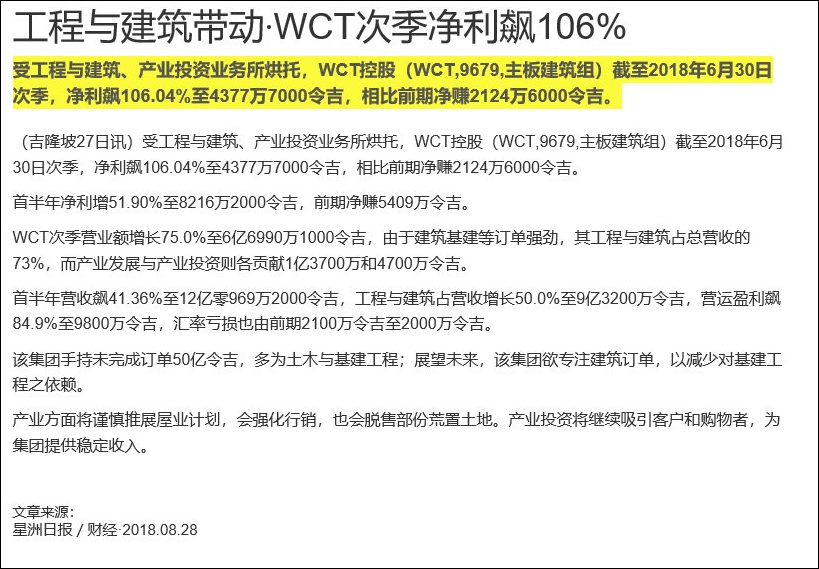

WCT控股第三季净利大跌35.6%

Supriya Surendran/theedgemarkets.com

November 26, 2018 19:51 pm +08

http://www.theedgemarkets.com/article/wct控股第三季净利大跌356

(吉隆坡26日讯)国内外基建设施项目营业额下跌,拖累WCT控股(WCT Holdings Bhd)截至今年9月杪第三季(2018财年第三季)净利按年劲挫35.6%至2613万令吉,上财年同季报4055万令吉。

该集团指出,产业销量下滑,也影响了盈利表现。每股盈利从2.92仙,跌至1.89仙。

2018财年第三季营业额按年萎缩17.8%至3亿8578万令吉,2017财年第三季报4亿6925万令吉。

累积现财年首9个月(2018财年首9个月),该集团净赚1亿829万令吉,比上财年同期的9464万令吉,按年上涨14.4%,归功于工程与建筑业务营业额增加。

2018财年首9个月营业额按年上升20.4%至15亿9000万令吉,2017财年首9个月为13亿2000万令吉。

2018财年首9个月每股盈利增至7.73仙,相对于2017财年首9个月为6.99仙。

WCT控股集团董事经理拿督李德福说:“在充满挑战的市场环境下,WCT今年迄今的表现符合我们的预期。”

“展望未来,我们对工程与建筑业务的前景保持乐观。目前,我们的订单总值70亿令吉,将为未来3至4年的收入和盈利提供可见性。”

他指出,该集团在推出任何新产业项目时,将继续保持谨慎态度,并将焦点集中于减少库存和改善营运现金流。

(编译:魏素雯)

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 385,779 | 469,255 | 1,595,471 | 1,324,953 | | 2 | Profit/(loss) before tax | 32,097 | 65,515 | 153,571 | 148,222 | | 3 | Profit/(loss) for the period | 22,988 | 40,288 | 102,968 | 92,026 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 26,127 | 40,551 | 108,289 | 94,641 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.89 | 2.92 | 7.73 | 6.99 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.2400 | 2.2200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-1-2019 06:32 AM

|

显示全部楼层

发表于 16-1-2019 06:32 AM

|

显示全部楼层

本帖最后由 icy97 于 19-1-2019 03:55 AM 编辑

wct林叶资本赢6.8亿工程-建118大楼购物中心

http://www.enanyang.my/news/20181222/wct林叶资本赢6-8亿工程br-建118大楼购物中心/

Type | Announcement | Subject | OTHERS | Description | Letter of Acceptance - Main Contract Work for a Shopping Complex Project known as "Cadangan Membina 1 Blok Bangunan Podium Kompleks Membeli-belah 8 Tingkat Di Fasa 2, Di Atas Lot 795, 796, 797, 799, 800, 20007, 20008 & Sebahagian Lot-Lot 743, 746, 802, 803, Mukim Bandar Kuala Lumpur, Daerah Kuala Lumpur, Wilayah Persekutuan" for PNB Merdeka Ventures Sdn Bhd | The Board of Directors of WCT Holdings Berhad (“WCT” or “the Company”) is pleased to announce that its wholly-owned subsidiary, WCT Berhad (“WCTB”) jointly together with TSR Bina Sdn Bhd (“TSRB”), a wholly-owned subsidiary of TSR Capital Berhad (“Joint Venture”), have on 21 December 2018 accepted and executed the Letter of Acceptance issued by PNB Merdeka Ventures Sdn. Bhd. (“the Employer”) in respect of the main contract work for a shopping complex project known as “Cadangan Membina 1 Blok Bangunan Podium Kompleks Membeli-belah 8 Tingkat Di Fasa 2, Di atas Lot 795, 796, 797, 799, 800, 20007, 20008 & Sebahagian Lot-Lot 743, 746, 802, 803, Mukim Bandar Kuala Lumpur, Daerah Kuala Lumpur, Wilayah Persekutuan” for a contract sum of RM676.8 million (excluding sales and service tax) (“the Contract”).

The shopping complex to be constructed forms part of the integrated development undertaken by PNB Merdeka Ventures Sdn Bhd known as Merdeka 118 , comprising amongst others the PNB 118 Tower, the Park Hyatt Hotel, and an observation deck.

Following the acceptance of the Contract, WCTB and TSRB shall in due course form an incorporated joint venture company in the ratio of 51:49 respectively to undertake the Contract.

The scope of works for the Contract generally includes the construction and completion of an 8 level shopping complex podium, including the architectural works for the basement, retail area, residential drop-off and core, tower link bridge and external works.

The Contract is expected to commence on 2 January 2019 and completed within 30 months (2½ years) from the commencement thereof.

None of the Directors or major shareholders of the Company or persons connected with them has any interest, direct or indirect, in the Contract.

This announcement is dated 21 December 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-1-2019 08:22 AM

|

显示全部楼层

发表于 26-1-2019 08:22 AM

|

显示全部楼层

Notice of Person Ceasing (Section 139 of CA 2016)Particulars of Substantial Securities HolderName | LEMBAGA TABUNG HAJI | Address | 201, Jalan Tun Razak

Kuala Lumpur

50400 Wilayah Persekutuan

Malaysia. | Company No. | ACT 535 (Tabung Haji Act 1995) | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares | Date of cessation | 28 Dec 2018 | Name & address of registered holder | LEMBAGA TABUNG HAJI201, Jalan Tun Razak, 50400 Kuala Lumpur |

No of securities disposed | 118,655,900 | Circumstances by reason of which a person ceases to be a substantial shareholder | Transfer of 118,655,900 shares to URUSHARTA JAMAAH SDN BHD as a result of a restructuring exercise. | Nature of interest | Direct Interest |  | Date of notice | 31 Dec 2018 | Date notice received by Listed Issuer | 31 Dec 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-2-2019 07:48 AM

|

显示全部楼层

发表于 25-2-2019 07:48 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Novation Agreement between Prasarana Malaysia Berhad and MRCB George Kent Sdn Bhd and WCT Berhad - Light Rail Transit Line 3 (LRT 3) from Bandar Utama to Johan Setia | Reference is made to the previous announcements made by the Company on the acceptance of the following packages under LRT 3 project by its wholly-owned subsidiary, WCT Berhad: - Package TD1 – Construction and Completion of Johan Setia Depot (Phase 1) and associated works. (Announcement dated 5 April 2017)

- Package GS02 – Construction and Completion of Guideway, Stations, Park and Ride, Ancillary Buildings and other associated works from Merchant Square to Suria Damansara (Announcement dated 5 October 2017)

- Package GS03 – Construction and Completion of Guideway, Stations, Park and Ride, Ancillary Buildings and other associated works from Suria Damansara to Temasya Glenmarie (Announcement dated 29 August 2017)

(Collectively referred to as “LRT 3 Work Packages”)

Following the acceptances of the LRT 3 Work Packages, WCT Berhad (“WCTB”) had since entered into three (3) separate construction contracts with Prasarana Malaysia Berhad (“Prasarana”) and MRCB George Kent Sdn Bhd (“MRCB George Kent”), governing the rights, interest, benefits, obligations, duties and liabilities of Prasarana, MRCB George Kent and WCTB for each of the LRT 3 Work Packages respectively (“LRT 3 Contracts”).

The Board of Directors of WCT Holdings Berhad (“WCT” or “the Company”) wishes to announce that WCTB had on 22 February 2019 executed three (3) separate Novation Agreements with Prasarana and MRCB George Kent , in which all of the rights, interest, benefits, obligations, duties and liabilities of Prasarana under the LRT 3 Contracts shall be transferred and conveyed absolutely to MRCB George Kent subject to the terms and conditions as stipulated in the respective Novation Agreement.

The entering into the Novation Agreements by WCTB has no material effect on the operations and financial position of the Company and its subsidiaries (“WCT Group”).

This announcement is dated 22 February 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-3-2019 04:40 AM

|

显示全部楼层

发表于 11-3-2019 04:40 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 737,905 | 679,999 | 2,333,376 | 2,004,952 | | 2 | Profit/(loss) before tax | 1,245 | 170,559 | 154,816 | 318,781 | | 3 | Profit/(loss) for the period | -52,832 | 133,440 | 50,136 | 225,466 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,492 | 133,530 | 111,781 | 228,171 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.25 | 9.61 | 8.01 | 16.67 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.71 | 3.00 | 1.71 | 3.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.2500 | 2.2200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-3-2019 04:44 AM

|

显示全部楼层

发表于 11-3-2019 04:44 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | WCT Holdings Berhad ("WCT" or "the Company")- Proposed Final Dividend | The Board of Directors of WCT is pleased to announce that the Board has resolved to recommend a final single tier share dividend via a distribution of treasury shares on the basis of two (2) treasury shares for every one hundred (100) existing ordinary shares held in the Company at a date of entitlement to be determined later in respect of the financial year ended 31 December 2018.

The aforesaid proposed final dividend is subject to the shareholders' approval being obtained at the Company's forthcoming Eighth Annual General Meeting and any fractions arising from the distribution of treasury shares will be disregarded and dealt with at the discretion of the Directors.

This announcement is dated 28 February 2019.

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|