|

|

【TIMECOM 5031 交流专区】时光网络

[复制链接]

[复制链接]

|

|

|

发表于 27-2-2018 04:09 AM

|

显示全部楼层

发表于 27-2-2018 04:09 AM

|

显示全部楼层

EX-date | 12 Mar 2018 | Entitlement date | 14 Mar 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Special Interim Tax Exempt (Single Tier) Dividend of 11.9 sen per ordinary share for the financial year ended 31 December 2017 | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 28 Mar 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 14 Mar 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.119 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-2-2018 04:09 AM

|

显示全部楼层

发表于 27-2-2018 04:09 AM

|

显示全部楼层

EX-date | 12 Mar 2018 | Entitlement date | 14 Mar 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Interim Ordinary Tax Exempt (Single Tier) Dividend of 5.3 sen per ordinary share for the financial year ended 31 December 2017 | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 28 Mar 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 14 Mar 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.053 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-5-2018 01:27 AM

|

显示全部楼层

发表于 12-5-2018 01:27 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 11-6-2018 02:54 AM

|

显示全部楼层

发表于 11-6-2018 02:54 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 230,730 | 218,418 | 230,730 | 218,418 | | 2 | Profit/(loss) before tax | 65,970 | 55,514 | 65,970 | 55,514 | | 3 | Profit/(loss) for the period | 62,940 | 53,048 | 62,940 | 53,048 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 62,940 | 53,048 | 62,940 | 53,048 | | 5 | Basic earnings/(loss) per share (Subunit) | 10.82 | 9.17 | 10.82 | 9.17 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.9200 | 3.9000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-6-2018 03:48 AM

|

显示全部楼层

发表于 16-6-2018 03:48 AM

|

显示全部楼层

本帖最后由 icy97 于 18-6-2018 03:03 AM 编辑

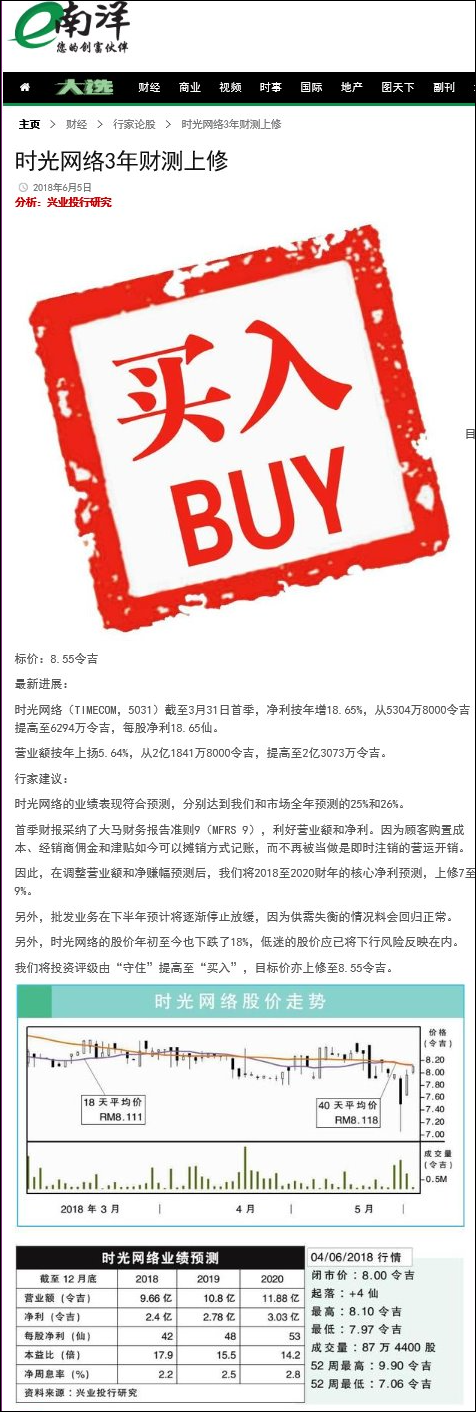

首季表现歷来最佳 时光网络全年可望再创新高

財经 最后更新 2018年06月4日 21时22分

隨著经营光纤电缆的时光网络(TIMECOM,5031,主板基建股)2018財政年首季(截至3月31日止)业绩表现不俗,分析员看好该公司今年业绩有望再创新高。

时光网路今年首季净利按年上涨18.65%,至6294万令吉;营业额也按年升5.64%,至2亿3013万令吉。

丰隆投行分析员说, 「这个首季是时光网络有史以来表现最好的一个季度,这使它的盈利有望在今年再创新高。因此,该股是我们电讯领域的首选股之一。」

针对宽频批发业务, 分析员指出, 由于不可取消使用权(IRU)销售萎靡,导致批发业务在今年首季按季和按年分別下跌了15%和19%。

不过,虽然宽频批发业务面临季节性疲弱,但经常性营收仍按季和按年上涨了3%和6%。

至于全球宽频业务,海底电缆首季的经常性营收,按季和按年分別增长17%和超过100%。隨著宽频批发价格仍高居不下,使客户更倾向租赁而非IRU。

不过,分析员认为,这种现象自年初起已开始扭转。年初至今,时光网络接获不少询问,尤其是来自中国。分析员认为,时光网络今年的IRU需求將回升,甚至有望超越去年。

与此同时,企业网络与通讯相关服务的营收在今年首季,按季和按年分別提高5%和9%,其中数据库存服务按年上升了10%。分析员指出,公司的Menara AIMS產能已到达100%,但產能扩充计划仍在探討中。

零售业务增长最快

另外,时光网络的零售业务仍是增长最快的业务,按季和按年暴涨了76%和14%。分析员表示,该公司今年將继续专注于提高市佔率。至于希盟政府近期正在探討「以半价获得更快的网速」的问题,分析员认为,这不会影响时光网络的业务,甚至能在技术上符合需求。「若政策真的实行, 相信时光网络有足够的能力应付,因为相关业务仅占公司营业额的20%。」

丰隆投行分析员重申对该股「买进」投资评级,目標价为9.75令吉。

「我们喜欢时光网络迅速发展的零售业务,而IRU需求復甦有助于公司盈利增长。」

技术面而言,该股从今年初起稍微滑落,并在上週四跌至1年新低的7.07令吉。

该股的弱势指数(RSI)为49.347点,属于「中和」区域。

【东方网财经】

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-7-2018 01:15 AM

|

显示全部楼层

发表于 11-7-2018 01:15 AM

|

显示全部楼层

本帖最后由 icy97 于 12-7-2018 05:12 AM 编辑

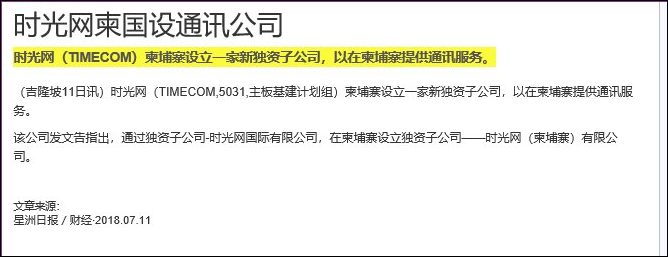

Type | Announcement | Subject | OTHERS | Description | TIME dotCom Berhad ("TIME" or "the Company") - Establishment of an Indirect Wholly-owned Subsidiary Company | The Board of Directors of TIME wishes to announce that TIME dotCom International Sdn Bhd (Company No. 1125366-T) ("TDCI"), a wholly-owned subsidiary of the Company, has established a wholly-owned subsidiary in Cambodia, namely TIME dotCom (Cambodia) Co., Ltd. ("TIME Cambodia") on 10 July 2018.

The principal activity of TIME Cambodia is provision of telecommunication services.

The establishment of TIME Cambodia will not have any material financial effect on earnings and net assets of the Company for the financial year ending 31 December 2018.

Save for Mr Patrick Corso being the common Director of TIME, TDCI and TIME Cambodia, none of the other Directors and/or major shareholders of TIME or persons connected to the Directors and/or major shareholders of TIME have any interest, direct or indirect in the establishment of TIME Cambodia.

This announcement is dated 10 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

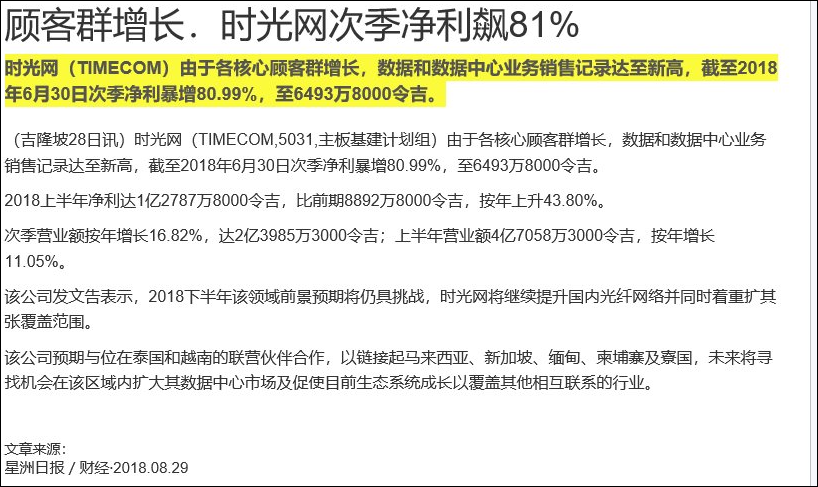

发表于 30-8-2018 07:24 AM

|

显示全部楼层

发表于 30-8-2018 07:24 AM

|

显示全部楼层

本帖最后由 icy97 于 4-9-2018 01:18 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 239,853 | 205,321 | 470,583 | 423,739 | | 2 | Profit/(loss) before tax | 68,527 | 37,880 | 134,497 | 93,394 | | 3 | Profit/(loss) for the period | 64,938 | 35,880 | 127,878 | 88,928 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 64,938 | 35,880 | 127,878 | 88,928 | | 5 | Basic earnings/(loss) per share (Subunit) | 11.17 | 6.20 | 21.99 | 15.38 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.0400 | 3.9000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-10-2018 03:34 AM

|

显示全部楼层

发表于 3-10-2018 03:34 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | TIME dotCom Berhad ("TIME" or "the Company") - Incorporation of a New Wholly-owned Subsidiary Company | The Board of Directors of TIME wishes to announce that the Company has incorporated a new wholly-owned subsidiary in Japan, namely TIME dotCom Japan K.K. The amount of paid-up capital is Yen100,000 comprising 100 shares of Yen1,000 each.

The principal activity of TIME dotCom Japan K.K. is the provision of telecommunication services, co-location and other related services.

The incorporation of TIME dotCom Japan K.K. is not expected to have any material financial effect on earnings and net assets of the Company.

Save for Mr Lee Guan Hong being the common Director of TIME and TIME dotCom Japan K.K., none of the other Directors and/or major shareholders of TIME or persons connected to the Directors and/or major shareholders of TIME have any interest, direct or indirect in TIME dotCom Japan K.K.

This announcement is dated 1 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-10-2018 05:30 AM

|

显示全部楼层

发表于 14-10-2018 05:30 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 27-12-2018 06:15 AM

|

显示全部楼层

发表于 27-12-2018 06:15 AM

|

显示全部楼层

本帖最后由 icy97 于 8-1-2019 08:02 AM 编辑

TIME dotCom第三季净利弹升183%

Gigi Chua/theedgemarkets.com

November 27, 2018 20:52 pm +08

http://www.theedgemarkets.com/article/time-dotcom第三季净利弹升183

(吉隆坡27日讯)TIME dotCom Berhad的第三季净利从2823万令吉,按年弹升183.3%至7998万令吉,归功于营业额增长及外汇收益。

截至今年9月杪季度营业额按年提高23.2%至2亿5000万令吉,上财年同季为2亿296万令吉。

该集团在现财年首9个月净赚2亿786万令吉,比上财年同期的1亿1716万令吉,按年骤升77.42%。

现财年首9个月营业额则按年上扬约15%至7亿2058万令吉,上财年同期报6亿2673万令吉,得益于数据(+25.3%)和数据中心(+13.4%)业务的经常性销售额增加。

随着市场业者调整定价以保持竞争力,TIME预计该行业将在今年内继续面临挑战。

该集团相信已经实施的策略,有望在长期内增加市场份额。随着该集团扩大零售客户群,该集团将继续专注于改善与拓展国内光纤网络足迹。

(编译:魏素雯)

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 249,999 | 202,995 | 720,582 | 626,734 | | 2 | Profit/(loss) before tax | 82,574 | 42,472 | 217,071 | 135,866 | | 3 | Profit/(loss) for the period | 79,981 | 28,229 | 207,859 | 117,157 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 79,981 | 28,229 | 207,859 | 117,157 | | 5 | Basic earnings/(loss) per share (Subunit) | 13.71 | 4.86 | 35.71 | 20.23 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.1700 | 3.9000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-2-2019 12:20 PM

|

显示全部楼层

发表于 12-2-2019 12:20 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 11-3-2019 05:40 AM

|

显示全部楼层

发表于 11-3-2019 05:40 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 262,853 | 233,962 | 983,435 | 860,696 | | 2 | Profit/(loss) before tax | 87,740 | 57,253 | 304,811 | 193,119 | | 3 | Profit/(loss) for the period | 80,811 | 58,205 | 288,670 | 175,362 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 80,811 | 58,205 | 288,670 | 175,362 | | 5 | Basic earnings/(loss) per share (Subunit) | 13.85 | 10.01 | 49.56 | 30.25 | | 6 | Proposed/Declared dividend per share (Subunit) | 20.56 | 17.20 | 20.56 | 17.20 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.3200 | 3.9000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-3-2019 05:48 AM

|

显示全部楼层

发表于 11-3-2019 05:48 AM

|

显示全部楼层

EX-date | 15 Mar 2019 | Entitlement date | 19 Mar 2019 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Special Interim Tax Exempt (Single Tier) Dividend of 11.31 sen per ordinary share for the financial year ended 31 December 2018 | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151/52 | Payment date | 29 Mar 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 19 Mar 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.1131 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-3-2019 05:50 AM

|

显示全部楼层

发表于 11-3-2019 05:50 AM

|

显示全部楼层

EX-date | 15 Mar 2019 | Entitlement date | 19 Mar 2019 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Interim Ordinary Tax Exempt (Single Tier) Dividend of 9.25 sen per ordinary share for the financial year ended 31 December 2018 | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151/52 | Payment date | 29 Mar 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 19 Mar 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0925 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-5-2019 07:17 PM

|

显示全部楼层

发表于 24-5-2019 07:17 PM

|

显示全部楼层

(吉隆坡24日讯)TIME dotCom Bhd首季净利从6294万令吉,扬升至6313万令吉。

该公司今日向大马交易所报备,截至3月杪首季营业额增13.8%至2亿6254万令吉,上财年同期报2亿3073万令吉。

该公司将季度表现归因于所有核心产品业务的销售提高,以分别增长15.2%和8.9%的数据及数据中心业务领涨。

[X] CLOSE

Advertisement

AIA Malaysia's Healthiest Workplace 2019

Find Out More volume_off

pause

fullscreen

“所有客户群也对营业额增长作出贡献,其中以零售业务为首,因TIME Fibre家庭宽频服务的需求持续。”

展望未来,该集团将继续与泰国、越南和柬埔寨的伙伴合作,建立一个无缝的区域电讯网络,将印度中国与大马及新加坡连接起来。

“集团还希望扩大数据中心的区域版图,并扩大目前的客户生态系统,以包括来自不同行业的相互关联业者。”

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-6-2019 02:41 AM

|

显示全部楼层

发表于 28-6-2019 02:41 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 262,542 | 230,730 | 262,542 | 230,730 | | 2 | Profit/(loss) before tax | 67,058 | 65,970 | 67,058 | 65,970 | | 3 | Profit/(loss) for the period | 63,132 | 62,940 | 63,132 | 62,940 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 63,132 | 62,940 | 63,132 | 62,940 | | 5 | Basic earnings/(loss) per share (Subunit) | 10.82 | 10.82 | 10.82 | 10.82 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.2400 | 4.3200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2019 08:04 AM

|

显示全部楼层

发表于 28-8-2019 08:04 AM

|

显示全部楼层

本帖最后由 icy97 于 29-8-2019 04:14 AM 编辑

联号贡献增‧时光网次季多赚43%

https://www.sinchew.com.my/content/content_2107320.html

(吉隆坡27日讯)营收升高以及联号公司贡献更高盈利,带动时光网(TIMECOM,5031,主板电讯媒体组)截至2019年6月30日止第二季净利增长42.45%至9250万1000令吉,上半年净利扬升21.70%至1亿5563万3000令吉。

第二季营业额扬升15.83%至2亿7782万4000令吉,上半年营收则增加14.83%至5亿4036万6000令吉。

时光网在文告中指出,所有核心产品都录得更高销售,以及所有核心顾客群都贡献整体营收成长,包括批发和零售顾客。

盈利增长则归功于整体营收升高、成本效率改善以及联号公司获更高盈利。

展望未来,该集团认为,将继续和泰国及越南的伙伴合作,以攫取东南亚跨境联接的需求。东南亚市场的需求正在升高,除了增加联接外,该集团也评估进军区域数据中心的商机。

文章来源 : 星洲日报 2019-08-28

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 277,824 | 239,853 | 540,366 | 470,583 | | 2 | Profit/(loss) before tax | 96,436 | 68,527 | 163,494 | 134,497 | | 3 | Profit/(loss) for the period | 92,501 | 64,938 | 155,633 | 127,878 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 92,501 | 64,938 | 155,633 | 127,878 | | 5 | Basic earnings/(loss) per share (Subunit) | 15.85 | 11.17 | 26.66 | 21.99 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.4300 | 4.3200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-9-2019 01:03 AM

|

显示全部楼层

发表于 20-9-2019 01:03 AM

|

显示全部楼层

想套利时光网……

https://www.sinchew.com.my/content/content_2117126.html

读者问:我从时光网(TIMECOM,5031,主板电讯媒体组)上市持有到现在,最近需要用到钱想套利,请问合理价是多少?这家公司的业务和前景是不是还很好?

答:

根据兴业研究最近的一份分析报告,时光网可望受到宽频销售增长拉抬,营收可按年增长12至15%,预期在零售业务具规模而突显成本效益,可使赚益维持稳定。

该公司目前有65万宽频用户,管理层目标是2020年杪增至100万户,因此零售营收可增至更具规模;预测在零售、数据中心与批发业务支撑下,今后3年的年营收复合增长率为12.2%。

盈利增长不俗

管理层执行力强

兴业认为时光网是大马受看好的电讯公司,主要是盈利增长不俗,具有扩展区域批发业务之潜能,管理层执行力强等优势,2019财政年盈利可增长18.6%至3亿3300万令吉。

兴业认为,其海底电缆、陆上电缆与数据中心不受看重,相信未来在宽频销售取得进展、云端服务/数据中心乃至全国光纤网络计划后,将形成盈利催化剂。时光网的海底电缆,乃至中南半岛国家的越南、柬埔寨和泰国贯通后,可从区域的数码转型浪潮受惠。

市场对云端服务的增长需求,将使时光网首屈一指的中和数据中心受惠。作为大马互联网交换中心(MyIX)的锚点,时光网提供全面云端方案,直通谷歌、亚马逊、微软Azure和阿里巴巴等云端服务者。

兴业说,作为亚马逊AWS服务的亚洲直通伙伴,使用时光网云端互通平台也可使AWS与数据中心等互通,进而形成更低网络成本、增加宽频流通及有更持续连贯的体验。

兴业建议“买进”时光网,目标价为10令吉30仙。

文章来源 : 星洲日报 2019-09-16 |

|

|

|

|

|

|

|

|

|

|

|

发表于 19-3-2020 08:09 AM

|

显示全部楼层

发表于 19-3-2020 08:09 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2019 | 30 Sep 2018 | 30 Sep 2019 | 30 Sep 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 278,164 | 249,999 | 818,530 | 720,582 | | 2 | Profit/(loss) before tax | 84,719 | 82,574 | 248,213 | 217,071 | | 3 | Profit/(loss) for the period | 82,994 | 79,981 | 238,627 | 207,859 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 82,994 | 79,981 | 238,627 | 207,859 | | 5 | Basic earnings/(loss) per share (Subunit) | 14.19 | 13.71 | 40.86 | 35.71 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.5800 | 4.3200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-5-2020 08:16 AM

|

显示全部楼层

发表于 3-5-2020 08:16 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2019 | 31 Dec 2018 | 31 Dec 2019 | 31 Dec 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 295,343 | 262,853 | 1,113,873 | 983,435 | | 2 | Profit/(loss) before tax | 79,915 | 87,740 | 328,128 | 304,811 | | 3 | Profit/(loss) for the period | 75,409 | 80,811 | 314,036 | 288,670 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 75,409 | 80,811 | 314,036 | 288,670 | | 5 | Basic earnings/(loss) per share (Subunit) | 12.88 | 13.85 | 53.73 | 49.56 | | 6 | Proposed/Declared dividend per share (Subunit) | 29.03 | 20.56 | 29.03 | 20.56 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.7300 | 4.3200

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|