|

|

楼主 |

发表于 3-10-2016 02:32 AM

|

显示全部楼层

必多第一设内部审计部

2016年10月2日

(吉隆坡1日讯)必多第一(PETONE,7027,主板贸服股)宣布,经过一番商议和研讨后,决定即刻起设立内部审计部。

必多第一表示,将尽早开始聘请合适人选加入该部。

一旦内部审计部成立,公司将根据特别审计报告里提出的调查重点,进行广泛审计,同时提升风险及内部管理。

没违反条规

早前,前任外部审计师毕马威(KPMG)对公司2015财年的财报发表“否定声明”(Disclaimer Opinion)后,必多第一已委任Moore Stephens Associates PLT为特别审计师。

毕马威表示,由于必多第一重组债务的状态不完整,因此有许多不稳定因素,导致毕马威对该公司继续营运的能力存有重大疑虑。

不过,在特别审计师展开验证后,认为公司并没有违反法律及条规。

然而,特别审计师发现,该公司及子公司可再进一步加强企业监管、风险管理和内部控制。【e南洋】

Type | Announcement | Subject | OTHERS | Description | PETROL ONE RESOURCES BERHAD ("THE COMPANY" OR "PETONE")- APPOINTMENT OF SPECIAL AUDITOR | Unless otherwise stated, all definitions and terms used in this announcement shall have the same meanings as defined in the previous announcements dated 2 December 2015, 1 March 2016, 31 May 2016, 30 June 2016, 26 July 2016, 23 August 2016 and 1 September 2016.

The Board wishes to announce that the Board had deliberated and resolved to set-up an in-house internal audit function within the Group with immediate effect where hiring of the candidates shall commence as soon as possible. The internal audit function once set up, will perform an extensive review on all findings highlighted in the Special Audit report as well as to improve the effectiveness of the risk management and internal control process of the Group.

This announcement is dated 30 September 2016. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 1-11-2016 04:29 AM

|

显示全部楼层

本帖最后由 icy97 于 2-11-2016 04:04 AM 编辑

必多第一财报遭“否定声明”

2016年11月1日

(吉隆坡31日讯)必多第一(PETONE,7027,主板贸服股)截至今年6月杪的财报,遭审计师发出“否定声明”(Disclaimer of Opinion)。

独立审计师Baker Tilly Monteiro Heng无法对今年财报给予意见,理由包括担忧集团是否能持续经营、无法获得足够合适的审计证据,以及特定账目的设想合适度。

审计师指出,近年来发生的事件,导致集团持续经营的能力受到怀疑。集团持续经营的程度,取决于股东是否批准重组计划和成功执行该计划、偿还拖欠债务及营运获利。

“对于财报中的子公司投资和子公司欠债账目,管理层是假设重组计划成功执行,来计算未来现金流和账面价值,因此,我们无法确定该账面价值的合适度。”

除此之外,由于审计报告中提及的问题自上财年至今还未解决,审计师无法决定营运成绩和累计亏损余额是否有必要调整。【e南洋】

Type | Announcement | Subject | OTHERS | Description | PETROL ONE RESOURCES BERHAD ("PETONE" OR "THE COMPANY")- QUALIFICATION IN EXTERNAL AUDITORS' REPORT FOR THE FINANCIAL STATEMENTS FOR THE FINANCIAL YEAR ENDED 30 JUNE 2016 | Pursuant to Paragraph 9.19(37) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, the Board of Directors of PETONE wishes to inform that the Auditors’ Report on the Audited Financial Statements of the Company for the Financial Year Ended 30 June 2016 contains a disclaimer opinion by the Company's External Auditors, Messrs. Baker Tilly Monteiro Heng.

A copy of the Auditors' Report is annexed herewith.

This announcement is made on 28 October 2016. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5246065

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 4-12-2016 06:09 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2016 | 30 Sep 2015 | 30 Sep 2016 | 30 Sep 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,904 | 2,455 | 2,904 | 2,455 | | 2 | Profit/(loss) before tax | 702 | 3,558 | 702 | 3,558 | | 3 | Profit/(loss) for the period | 702 | 3,553 | 702 | 3,553 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 702 | 3,553 | 702 | 3,553 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.38 | 6.99 | 1.38 | 6.99 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -2.0734 | -2.0371

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 27-12-2016 03:36 AM

|

显示全部楼层

必多第一冀半年完成重组

明年下半执行新合约

2016年12月22日

(八打灵再也21日讯)必多第一(PETONE,7027,主板贸服股)放眼未来半年内完成重组计划,并在明年下半年开始执行新合约。

针对该公司冀望何时脱离PN17行列,必多第一执行董事吕玮泓今日说:“我们不能保证,因为有很多因素存在,其一是大马交易所。”

必多第一自2012年以来,因抵触大马交易所主板PN17条例,而被列入PN17公司行列,至今仍未能脱离行列。

目前该公司正在着手重组计划。

他今日出席股东常年大会后记者会上如是指出,出席者还包括必多第一总执行长阿兹兰沙依利和财务总监沈承隆。

另外,吕玮泓指出,该公司最快会在明年下半年开始执行新合约,并为2017财年或2018财年做出盈利贡献。

他解释:“公司业务重心仍是油气业,因为大马对油气的需求量很高,冀望未来能取得新的储油终端管理合约。”

还补充,接下来,放眼的新合约都是为期至少2到3年,过去的旧合约期限一般都是2年。

此外,他透露,该公司的船舶运营合约(STS)已经结束,因此,相信新合约能够填补该空缺。

不过,他未说明手中订单有多少,只透露现有合约充足,能让公司在未来1年都处繁忙阶段。

有足够资金收购

早前,必多第一子公司必多第一控股私人有限公司与WEBS汽油私人有限公司签署了解备忘录,以收购巴生西港一家油气码头公司。

吕玮泓说:“这项收购计划,需待完成重组计划后方可执行,即未来6个月内完成重组计划。”

他解释,尽管公司仍负债,但现有的流动资金处于健康水平,因此有足够的资金进行收购计划。

必多第一目前所持有的现金达至143万9222令吉。

另外,石油输出国组织(OPEC)与非OPEC产油国同意一起减产,石油价格上涨,但必多第一从事的是下游业务,因此,业务冲击不大。

吕玮泓说:“我们认为,不论油价是起或落,客户还是要储油的,因此我们觉得没有太直接的影响。”【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 22-2-2017 03:02 AM

|

显示全部楼层

本帖最后由 icy97 于 22-2-2017 05:13 AM 编辑

必多第一验船合约延长2年

2017年2月22日

(吉隆坡21日讯)必多第一(PETONE,7027,主板贸服股)公布,独资子公司One Petroleum(OPLL)的验船合约获得延长两年,至2018年12月31日。

必多第一今日向马交所报备,OPLL与Avantgarde航运有限公司(ASL)在2013年11月4日签署的验船合约,从今年1月1日开始延长两年。

根据延长协议,OPLL将为ASL旗下油轮进行的船舶运营提供咨询服务。

同时,ASL每个月将支付11万5000美元(约51万2590令吉)的咨询服务费用给OPLL。【e南洋】

Type | Announcement | Subject | OTHERS | Description | PETROL ONE RESOURCES BERHAD ("COMPANY" OR "PETONE") - ADDENDUM TO THE SURVEYOR AGREEMENT DATED 4 NOVEMBER 2013 BETWEEN AVANTGARDE SHIPPING LIMITED ("ASL") AND ONE PETROLEUM (L) LIMITED ("OPLL") ("SURVEYOR AGREEMENT") ("ADDENDUM AGREEMENT") | 1. INTRODUCTION

The Board of Directors of PETONE (“Board”) wishes to announce that its indirect wholly-owned subsidiary, OPLL had on 21 February 2017 entered into the Addendum Agreement to extend the duration of the Surveyor Agreement for a further period of two (2) years effective from 1 January 2017.

Under the Surveyor Agreement, OPLL is to provide consultation services for ship-to-ship (“STS”) transfer operation for oil products stored on the oil tanker vessel chartered or owned by ASL (“Vessel”).

2. BACKGROUND INFORMATION ON ASL

ASL (Company Registration Number: 1762798) is a company incorporated in the British Virgin Islands and having its office address at Suite 605, China Insurance Group Building, 141 Des Voeux Road, Central Hong Kong. The director of ASL is Hamed Kachoee.

3. SALIENT TERMS OF THE ADDENDUM AGREEMENT

The salient terms of the Addendum Agreement are as follows:

(i) OPLL and ASL are desirous to extend the tenure of the Surveyor Agreement for a further period of 2 years from 1 January 2017, with the new expiry date being 31 December 2018 and the Surveyor Agreement shall remain in full force and effect unless terminated earlier by either party in accordance with the terms set out in the Surveyor Agreement; and

(ii) Save for the abovementioned, all other terms and conditions of the Surveyor Agreement shall remain unchanged.

For information purposes, the salient terms of the Surveyor Agreement are as follows:

(i) OPLL shall provide consultation services in relation to STS transfer operation which include technical management, commercial management, accounting services, supply of provisions at ASL expense, bunkering and assisting and arranging for the application of relevant permits and licences; and

(ii) ASL shall pay to OPLL for their consultation services a monthly consultation fee of USD115,000.00.

4. FINANCIAL EFFECTS

The Addendum Agreement does not have any effect on the share capital, substantial shareholders’ shareholdings, net assets and gearing of PETONE. The Addendum Agreement is expected to contribute positively to the consolidated earnings per share of PETONE for the FYE 30 June 2017.

5. APPROVALS REQUIRED

The Addendum Agreement is not subject to the approval of shareholders of PETONE or any regulatory authorities. The Addendum Agreement is not conditional upon any other corporate exercise undertaken or to be undertaken by PETONE.

6. DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTERESTS

None of the directors of PETONE and/or major shareholders of PETONE and/or persons connected to them have any interest, direct or indirect, in the Addendum Agreement.

7. DIRECTORS’ STATEMENT

The Board is of the opinion that the Addendum Agreement is in the best interest of PETONE and its subsidiaries.

This announcement is dated 21 February 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 7-3-2017 05:40 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2016 | 31 Dec 2015 | 31 Dec 2016 | 31 Dec 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,960 | 2,618 | 5,864 | 5,073 | | 2 | Profit/(loss) before tax | 915 | 119 | 1,618 | 3,676 | | 3 | Profit/(loss) for the period | 915 | 114 | 1,618 | 3,666 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 915 | 114 | 1,618 | 3,666 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.80 | 0.22 | 3.18 | 7.22 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -2.2017 | -2.0371

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 7-3-2017 06:39 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PETROL ONE RESOURCES BERHAD ("COMPANY" OR "PETONE") - SUPPORT SERVICES AGREEMENT BETWEEN DALIAN JINZHOU HEAVY MACHINERY COMPANY LIMITED AND PETROL ONE OFFSHORE SDN BHD | 1. INTRODUCTION

The Board of Directors of PETONE (“Board”) wishes to announce that its indirect wholly-owned subsidiary, POOSB, had on 9 February 2017 entered into a support services agreement (“Support Services Agreement”) with DJHM (hereinafter collectively referred to as “Parties”) for the engagement of POOSB to provide supply base and marine support services (“Support Services”), to the oil storage terminal engineering procurement and construction works of DJHM located at Tanjung Bin, Johor Darul Takzim for the project known as the Asia Petroleum Hub Terminal Facilities (“Project”).

On 28 February 2017, DJHM had issued a letter to POOSB on even date to further advise that the Support Services Agreement is for the duration of 24 months and is scheduled to commence in the second half of year 2017.

2. BACKGROUND INFORMATION ON DJHM

DJHM (Company Number: 8015702-Z) is a company incorporated in People’s Republic of China and having its business address at 5, Longwan Road, Jinzhou District, Dalian 116100, People's Republic of China. It is principally involved in the manufacturing of large chemical, petrochemical, petroleum refining and fertilizer process equipment, and environmental protection equipment.

3. SALIENT TERMS OF THE SUPPORT SERVICES AGREEMENT

The salient terms of the Support Services Agreement are as follows:

(i) subject to the DJHM being appointed as the Contractor for the Project, DJHM shall appoint POOSB as its Service Provider for the Project;

(ii) POOSB agrees to provide the Support Services to DJHM, which involves provision of supply base with 5 acres of land adjacent to the Port of Tanjung Pelepas in Johor, warehouse and logistic support, agency services and custom clearance, as well as marine support services, which includes amongst others, launch services, tugs, barges and towage, pilotage, floating cranes, accommodation and victualing;

(iii) DJHM agrees to pay POOSB a fee for the Support Services at a rate of cost (“Cost”) plus 5% and as agreed between the Parties from time to time. As at this juncture, POOSB and DJHM are still in the midst of finalising the details of the Cost. A subsequent announcement will be made accordingly upon finalisation of the Cost;

(iv) the Support Services Agreement shall forthwith terminate in the event of:

(a) POOSB ceasing for any reason to be or remain liable to perform its obligations under the terms of the Support Services Agreement;

(b) a court of competent jurisdiction makes an order or a resolution is passed for the winding up or administration (whether out of court or otherwise) of POOSB (otherwise than in the course of a bona fide reorganisation or restructuring previously approved in writing by DJHM) or a receiver, manager, administrator, administrative receiver or other similar officer is appointed in respect of any assets of POOSB; or

(c) either party may terminate the Support Services Agreement forthwith on six (6) calendar months’ notice; or

(d) by mutual agreement between the Parties.

4. FINANCIAL EFFECTS

The Support Services Agreement does not have any effect on the share capital, substantial shareholders’ shareholdings, net assets and gearing of PETONE. The Support Services Agreement is expected to contribute positively to the consolidated earnings per share of PETONE for the financial year ending 30 June 2018.

5. APPROVALS REQUIRED

The Support Services Agreement is not subject to the approval of shareholders of PETONE or any regulatory authorities. The Support Services Agreement is not conditional upon any other corporate exercise undertaken or to be undertaken by PETONE.

6. DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTERESTS

None of the directors of PETONE and/or major shareholders of PETONE and/or persons connected to them have any interest, direct or indirect, in the Support Services Agreement.

7. DIRECTORS’ STATEMENT

The Board is of the opinion that the Support Services Agreement is in the best interest of PETONE and its subsidiaries.

This announcement is dated 1 March 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 13-6-2017 08:02 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2017 | 31 Mar 2016 | 31 Mar 2017 | 31 Mar 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,795 | 2,108 | 8,660 | 7,181 | | 2 | Profit/(loss) before tax | 123 | -1,583 | 1,740 | 2,094 | | 3 | Profit/(loss) for the period | 104 | -1,583 | 1,721 | 2,084 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 104 | -1,583 | 1,721 | 2,084 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.20 | -3.12 | 3.39 | 4.10 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -2.1754 | -1.9704

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 31-8-2017 01:07 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 3,204 | 3,182 | 11,864 | 10,363 | | 2 | Profit/(loss) before tax | 13 | -449 | 1,754 | 722 | | 3 | Profit/(loss) for the period | 13 | -459 | 1,735 | 702 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 13 | -459 | 1,735 | 702 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.03 | -0.90 | 3.42 | 1.38 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -2.1206 | -2.0371

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 31-10-2017 04:05 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PETROL ONE RESOURCES BERHAD ("PETONE" OR "THE COMPANY")- QUALIFICATION IN EXTERNAL AUDITORS' REPORT FOR THE FINANCIAL STATEMENTS FOR THE FINANCIAL YEAR ENDED 30 JUNE 2017 | Pursuant to Paragraph 9.19(37) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, the Board of Directors of PETONE wishes to inform that the Auditors’ Report on the Audited Financial Statements of the Company for the financial year ended 30 June 2017 contains a disclaimer opinion by the Company's External Auditors, Messrs. Baker Tilly Monteiro Heng.

A copy of the Auditors' Report is annexed herewith.

This announcement is made on 30 October 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5585957

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 5-12-2017 03:16 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 3,353 | 2,904 | 3,353 | 2,904 | | 2 | Profit/(loss) before tax | -337 | 702 | -337 | 702 | | 3 | Profit/(loss) for the period | -342 | 702 | -342 | 702 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -342 | 702 | -342 | 702 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.67 | 1.38 | -0.67 | 1.38 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -1.6794 | -2.0734

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-2-2018 04:24 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 3,196 | 2,961 | 6,549 | 5,864 | | 2 | Profit/(loss) before tax | 424 | 916 | 87 | 1,618 | | 3 | Profit/(loss) for the period | 419 | 916 | 77 | 1,618 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 419 | 916 | 77 | 1,618 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.82 | 1.80 | 0.15 | 3.18 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -1.6194 | -1.6957

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 27-5-2018 05:06 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,992 | 2,795 | 9,541 | 8,660 | | 2 | Profit/(loss) before tax | 26 | 123 | 113 | 1,740 | | 3 | Profit/(loss) for the period | 21 | 104 | 98 | 1,721 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 21 | 104 | 98 | 1,721 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.04 | 0.20 | 0.19 | 3.39 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -1.5543 | -1.6957

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 11-8-2018 04:34 AM

|

显示全部楼层

本帖最后由 icy97 于 12-8-2018 03:30 AM 编辑

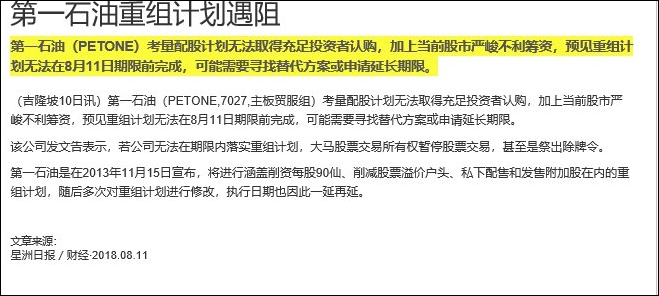

Type | Announcement | Subject | PRACTICE NOTE 17 / GUIDANCE NOTE 3

REGULARISATION PLAN | Description | PETROL ONE RESOURCES BERHAD ("COMPANY" OR "PETONE") - PROPOSED REGULARISATION PLAN | Unless otherwise stated, all definitions and terms used in this announcement shall have the same meanings as defined in the announcements dated 15 November 2013, 28 March 2014, 21 January 2015, 14 August 2015, 28 July 2016, 16 March 2017, 27 July 2017, 28 July 2017, 7 September 2017, 8 February 2018 and 29 March 2018.

Reference is made to the announcements dated 15 November 2013, 28 March 2014, 21 January 2015, 14 August 2015, 28 July 2016, 16 March 2017, 27 July 2017, 28 July 2017, 7 September 2017, 8 February 2018 and 29 March 2018 in relation to the Proposed Regularisation Plan.

On behalf of the Board of Directors, PIVB wishes to announce that a Board meeting was held on 9 August 2018 to deliberate the following in relation to the Proposed Regularisation Plan:

(i) the Company is unable to fully secure suitable placees for the entire tranche of the Placement Shares, despite numerous efforts from the Company to actively engage and source for suitable placees. This is partly due to the commitment required from the placees to subscribe for both the Placement Shares and corresponding Rights Shares as the amount involved is relatively substantial; and

(ii) the current challenging equity market conditions for fund raising exercise.

Based on the above factors, the Board has resolved that due to the uncertainties of the issues mentioned above, the Company is unable to implement the Proposed Regularisation Plan by 11 August 2018 (the extension of time granted by Bursa Securities via its approval letter dated 29 March 2018) and/or to formulate a concrete alternative scheme for a further extension of time application at this juncture.

Pursuant to the approval letter from Bursa Securities dated 29 March 2018 for the extension of time granted up to 11 August 2018 to implement the Proposed Regularisation Plan (“EOT”), the aforesaid EOT is without prejudice to Bursa Securities’ right to proceed to suspend the trading of the listed securities of PETONE and to de-list the Company in the event the Company fails to implement its Proposed Regularisation Plan within the time frame or extended time frame stipulated by any of the regulatory authorities.

Upon occurrence of the event above, Bursa Securities shall suspend the trading of the listed securities of PETONE on the 6th market day after the date of notification of suspension by Bursa Securities and de-list the Company, subject to the Company’s right to appeal against the delisting.

This announcement is dated 10 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 14-8-2018 12:04 AM

|

显示全部楼层

本帖最后由 icy97 于 14-8-2018 04:01 AM 编辑

Petrol One将于下周五除牌

Samantha Ho/theedgemarkets.com

August 13, 2018 20:05 pm +08

(吉隆坡13日讯)由于未能在11日之前落实重组计划,Petrol One Resources Bhd预定将于下周五(24日)自大马交易所主板除牌。

根据今日向马交所的报备,除非这家PN17公司在20日之前就除牌提出上诉。

“如果Petrol One在上诉期限内向马交易提交上诉,24日的除牌将推迟,以待上诉决定出炉。”

自审计师对2011财政年的审核账目无法表示意见,以及主要子公司违约,于2012年8月30日列入PN17的Petrol One曾多次获得延期,以落实重组计划。

该公司曾表示,所面临的问题包括配股计划无法获得充足认购,以及当前股票市场具挑战。

该股自2014年以来暂停交易。

(编译:陈慧珊)

Type | Announcement | Subject | PRACTICE NOTE 17 / GUIDANCE NOTE 3

SUSPENSION AND/OR DELISTING | Description | PETROL ONE RESOURCES BERHAD ("COMPANY" OR "PETONE") - SUSPENSION AND DE-LISTING OF THE SECURITIES OF THE COMPANY | Unless otherwise stated, all definitions and terms used in this announcement shall have the same meanings as defined in the announcements dated 15 November 2013, 28 March 2014, 21 January 2015, 14 August 2015, 28 July 2016, 16 March 2017, 27 July 2017, 28 July 2017, 7 September 2017, 8 February 2018, 29 March 2018 and 10 August 2018.

Reference is made to the announcements dated 15 November 2013, 28 March 2014, 21 January 2015, 14 August 2015, 28 July 2016, 16 March 2017, 27 July 2017, 28 July 2017, 7 September 2017, 8 February 2018, 29 March 2018 and 10 August 2018 in relation to the Proposed Regularisation Plan.

The Board wishes to announce that Bursa Securities had vide its letter dated 13 August 2018, noted the following: (1) Bursa Securities had on 14 August 2015 approved the Company’s regularisation plan.

(2) Pursuant to paragraph 5.2(b) of Practice Note 17, PETONE must complete the implementation of the Company’s regularisation plan which involved court proceedings within 12 months from the date the plan was approved by Bursa Securities i.e. 13 August 2016.

(3) Bursa Securities had granted the Company the following extensions of time to complete the implementation of its regularisation plan: (i) on 15 March 2017, a 12 months extension of time up to 13 August 2017; (ii) on 7 September 2017, a 6 months extension of time up to 12 February 2018; and (iii) on 29 March 2018, a 6 months extension of time up to 11 August 2018.

(4) PETONE had on 10 August 2018 announced amongst others, that the Company is unable to implement the regularisation plan by 11 August 2018 and/or to formulate a concrete alternative scheme for a further extension of time application at this juncture.

In the circumstances and pursuant to paragraph 8.04(5) of the Listing Requirements: (a) the trading in the securities of the Company will be and/or remain suspended with effect from 21 August 2018; and (b) the securities of the Company will be de-listed on 24 August 2018 unless an appeal against the de-listing is submitted to Bursa Securities on or before 20 August 2018 (“the Appeal Timeframe”). Any appeal submitted after the Appeal Timeframe will not be considered by Bursa Securities.

In the event the Company submits an appeal to Bursa Securities within the Appeal Timeframe, the removal of the securities of the Company from the Official List of Bursa Securities on 24 August 2018 shall be deferred pending the decision on the Company’s appeal.

With respect to the securities of the Company which are currently deposited with Bursa Malaysia Depository Sdn Bhd (“Bursa Depository”), the securities may remain deposited with Bursa Depository notwithstanding the de-listing of the securities from the Official List of Bursa Securities. It is not mandatory for the securities of a company which has been de-listed to be withdrawn from Bursa Depository.

Alternatively, shareholders of the Company who intend to hold their securities in the form of physical certificates, can withdraw these securities from their Central Depository System (CDS) accounts maintained with Bursa Depository at any time after the securities of the Company have been de-listed from the Official List of Bursa Securities. This can be effected by the shareholders submitting an application form for withdrawal in accordance with the procedures prescribed by Bursa Depository. These shareholders can contact any Participating Organisation of Bursa Securities and/or Bursa Securities’ General Line at 03-2034 7000 for further information on the withdrawal procedures.

Upon the de-listing of the Company, the Company will continue to exist but as an unlisted entity. The Company is still able to continue its operations and business and proceed with its corporate restructuring and its shareholders can still be rewarded by the Company’s performance. However, the shareholders will be holding shares which are no longer quoted and traded on Bursa Securities.

This announcement is dated 13 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-8-2018 03:58 AM

|

显示全部楼层

Type | Announcement | Subject | PRACTICE NOTE 17 / GUIDANCE NOTE 3

SUSPENSION AND/OR DELISTING | Description | PETROL ONE RESOURCES BERHAD ("THE COMPANY" OR "PETONE")- SUBMISSION OF APPEAL AGAINST SUSPENSION AND DELISTING OF THE SECURITIES OF THE COMPANY | Unless otherwise stated, all definitions and terms used in this announcement shall have the same meanings as defined in the announcements dated 15 November 2013, 28 March 2014, 21 January 2015, 14 August 2015, 28 July 2016, 16 March 2017, 27 July 2017, 28 July 2017, 7 September 2017, 8 February 2018, 29 March 2018, 10 August 2018 and 13 August 2018.

Reference is made to the announcement dated 13 August 2018 where Bursa Malaysia Securities Berhad ("Bursa Securities") issued the letter of suspension and de-listing of the securities of PETONE from Bursa Securities.

The Board of Directors of PETONE wishes to announce that it had on 20 August 2018 submitted an appeal against the suspension and de-listing to Bursa Securities ("Appeal").

Given that the Appeal was submitted within the Appeal Timeframe (i.e. by 20 August 2018), the removal of the securities of the Company from the Official List of Bursa Securities on 24 August 2018 shall be deferred pending the decision by Bursa Securities on the Appeal.

The announcement is dated 20 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 7-9-2018 03:01 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,977 | 3,204 | 12,518 | 11,864 | | 2 | Profit/(loss) before tax | -10,604 | 13 | -10,491 | 73,786 | | 3 | Profit/(loss) for the period | -10,609 | 13 | -10,511 | 73,767 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -10,609 | 13 | -10,511 | 73,767 | | 5 | Basic earnings/(loss) per share (Subunit) | -20.88 | 0.03 | -20.69 | 145.20 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -0.6918 | -0.5625

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 5-11-2018 01:55 AM

|

显示全部楼层

Type | Announcement | Subject | AUDIT REPORT - MODIFIED OPINION / MATERIAL UNCERTAINTY RELATED TO GOING CONCERN

DISCLAIMER OF OPINION | Description | PETROL ONE RESOURCES BERHAD ("PETONE" OR "THE COMPANY")- DISCLAIMER OPINION ON THE AUDITED FINANCIAL STATEMENTS FOR THE FINANCIAL YEAR ENDED 30 JUNE 2018 | Pursuant to Paragraph 9.19(37) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, the Board of Directors of PETONE wishes to inform that the Auditors’ Report on the Audited Financial Statements of the Company for the financial year ended 30 June 2018 contains a disclaimer opinion by the Company's External Auditors, Messrs. Baker Tilly Monteiro Heng.

A copy of the Auditors' Report is annexed herewith.

This announcement is dated 31 October 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5962417

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 30-12-2018 07:47 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,077 | 3,353 | 1,077 | 3,353 | | 2 | Profit/(loss) before tax | -197 | -337 | -197 | -337 | | 3 | Profit/(loss) for the period | -202 | -342 | -202 | -342 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -202 | -342 | -202 | -342 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.40 | -0.67 | -0.40 | -0.67 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -0.7395 | -0.7428

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 13-1-2019 07:01 AM

|

显示全部楼层

De-Listing of Petrol One Resources Berhad| PETROL ONE RESOURCES BERHAD |

Bursa Malaysia Securities Berhad (Bursa Securities) had dismissed Petrol One Resources Berhad’s further appeal for an extension of time to submit the revised regularisation plan to the relevant authorities for approval and decided to de-list the Company pursuant to paragraph 8.04 of the Bursa Securities Main Market Listing Requirements.

In the circumstances, the securities of the Company will be removed from the Official List of Bursa Securities on Monday, 17 December 2018.

Effect of De-listing from the Official List of Bursa Securities

With respect to the securities of the Company which are currently deposited with Bursa Malaysia Depository Sdn Bhd ("Bursa Depository"), the securities may remain deposited with Bursa Depository notwithstanding the de-listing of the company’s securities from the Official List of Bursa Securities. It is not mandatory for the securities of a company which has been de-listed to be withdrawn from Bursa Depository.

Alternatively, shareholders of the Company who intend to hold their securities in the form of physical certificates can withdraw these securities from their Central Depository System (CDS) accounts maintained with Bursa Depository at any time after the securities of the company have been de-listed from the Official List of Bursa Securities.

This can be effected by the shareholders submitting an application form for withdrawal in accordance with the procedures prescribed by Bursa Depository. These shareholders can contact any Participating Organisation of Bursa Securities and/or Bursa Securities’ General Line at 03-2034 7000 for further information on the withdrawal procedures.

Upon the de-listing of the company, the company will continue to exist but as an unlisted entity. The company is still able to continue its operations and business and proceed with its corporate restructuring and its shareholders can still be rewarded by the company’s performance. However, the shareholders will be holding shares which are no longer quoted and traded on Bursa Securities.

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|